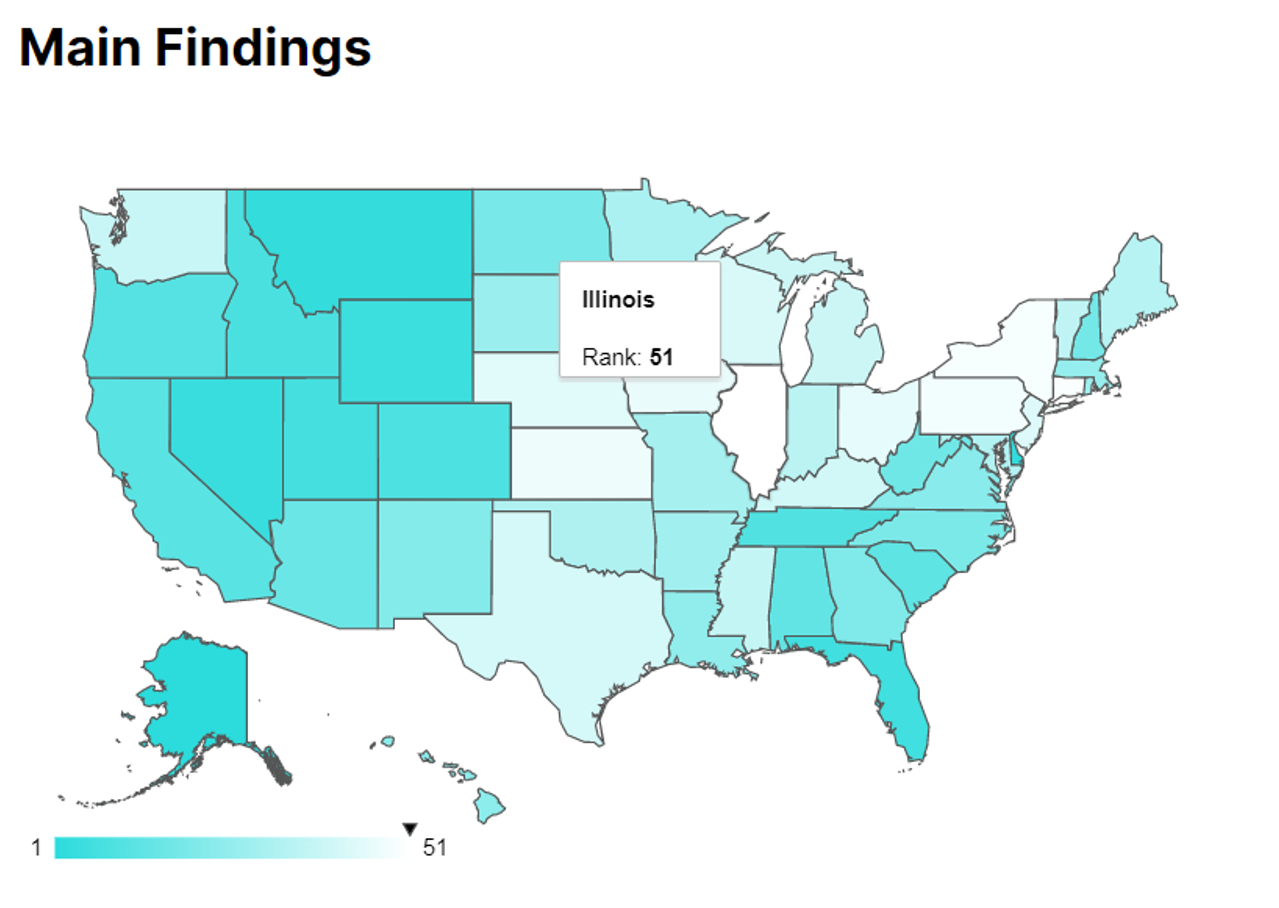

According to a new study from the personal-finance website WalletHub. Illinois’ combined state and local tax rate of nearly 15.1% is the highest among all 50 states and the District of Columbia. The dubious distinction comes at a time when Illinois is forecast to bring in billions in revenue above projected estimates, and underscores the urgent need for permanent tax relief. In Illinois, state and local tax payments by households making the median U.S. income amounted to $10,463, the highest amount in the nation.

When adjusted for cost of living, Illinois still ranks 47th on the list.

https://wallethub.com/edu/best-worst-states-to-be-a-taxpayer/2416